The Real Crypto Movement

Published 30 April 2022 by Denis "Jaromil" Roio

“From Commons to NFTs” is an (expanded) writing series initiated by Shu Lea Cheang, Felix Stalder & Ewen Chardronnet. Cautioned by the speculative bubble (burst) of NFTs, the series brings back the notion of commons from around the turn of the millennium to reflect upon and intervene in the transformation of the collective imagination and its divergent futures. Every last day of the month Makery publishes a new contribution of these “chain essays”. Fourth text by Denis ‘Jaromil’ Roio.

“The most powerful forces, those that interest us the most, are not in a specular and negative relation to modernity, to the contrary they move on transversal trajectories. On this basis we shouldn’t conclude that they oppose everything that is modern and rational, but that are engaged in creating new forms of rationality and new forms of liberation.”

– Negri and Hardt, 2010, “Commonwealth”

Since Bitcoin has broken the taboo on money about 10 years ago a lot has happened in the crypto space, in this brief essay I will explore some techno-political devices and promises that are staged today. I draw my insights and intuitions from an early involvement in the cypherpunk underground subculture. In this context I have written and advised the development of code in Bitcoin core, I have almost accidentally written what became the Bitcoin Manifesto and I have published early forks of the Bitcoin code. It was just the beginning of Bitcoin’s success when a few of us predicted “alt-coins” would soon appear: I was then among the first people to use the term “blockchain” to indicate the technical stack that empowered Bitcoin’s growth of a decentralized network at a planetary scale and envisioned its evolution in non-financial use-cases in the fields of energy, art and notarization.

Rather than an historical account, my effort here will be to share insights on the future of what is commonly referred to as “crypto” and whose hype may be at its surreality peak in 2022 with the Non-Fungible Token (NFT) market of digital collectibles.

I will also suggest a silver lining to the ethics of a global movement whose ideology will be of great influence for the future of technology: through this document I will demonstrate that the real crypto movement is not a trade-show of sociopaths in Las Vegas, but a contemporary iteration of the commons movement in the age of crypto.

I’ll be moving through contested grounds to suggest that the genesis of what today is marketed as the hyper-financial exploitation of exchange value of virtual assets is underpinned by a technology that still holds use-value for a movement of resistance against the global corruption of governments and mega-corporations.

From underground rebellion to global currency

The birth of the “crypto movement” is inscribed in an eclatant episode of financial injustice: the Wikileaks blockade. Here a quote of the historical communicate published on their website:

Since 7th December 2010 an arbitrary and unlawful financial blockade has been imposed by Bank of America, VISA, MasterCard, PayPal and Western Union. The attack has destroyed 95% of our revenue. [. . . ] The blockade is outside of any accountable, public process. It is without democratic oversight or transparency. The US government itself found that there were no lawful grounds to add WikiLeaks to a US financial blockade. [. . . ] The UN High Commissioner for Human Rights has openly criticized the financial blockade against WikiLeaks. [. . . ] The blockade erects a wall between us and our supporters, preventing them from affiliating with and defending the cause of their choice. It violates the competition laws and trade practice legislation of numerous states. It arbitrarily singles out an organization that has not committed any illegal act in any country and cuts it off from its financial lifeline in every country. [. . . ] In the US, our publishing is protected by the First Amendment, as has been repeatedly demonstrated by a wide variety of respected legal experts on the US Constitution. In January 2011 the U.S. Secretary of the Treasury, Timothy C. Geithner, announced that there were no grounds to blacklist WikiLeaks. There are no judgements, or even charges, against WikiLeaks or its staff anywhere in the world.

The blockade was an immediate reaction to the “cablegates release”, where an enormous amount of classified USA diplomatic documents had been published by Wikileaks. This episode did not please many powerful people in the USA (arguably, Wikileaks has hit its military-industrial complex in many ways). Though the Wikileaks organization received much appreciation from all over the world, also in the form of monetary donations. While the media wave of cablegates was reverberating through the world’s screens, international transaction monopolies like Maestro and Visa blocked Wikileaks from receiving donations, without a legal mandate, or a court case order. Wikileaks also had its registered Internet domains obscured, with the exception of the one registered in Switzerland.

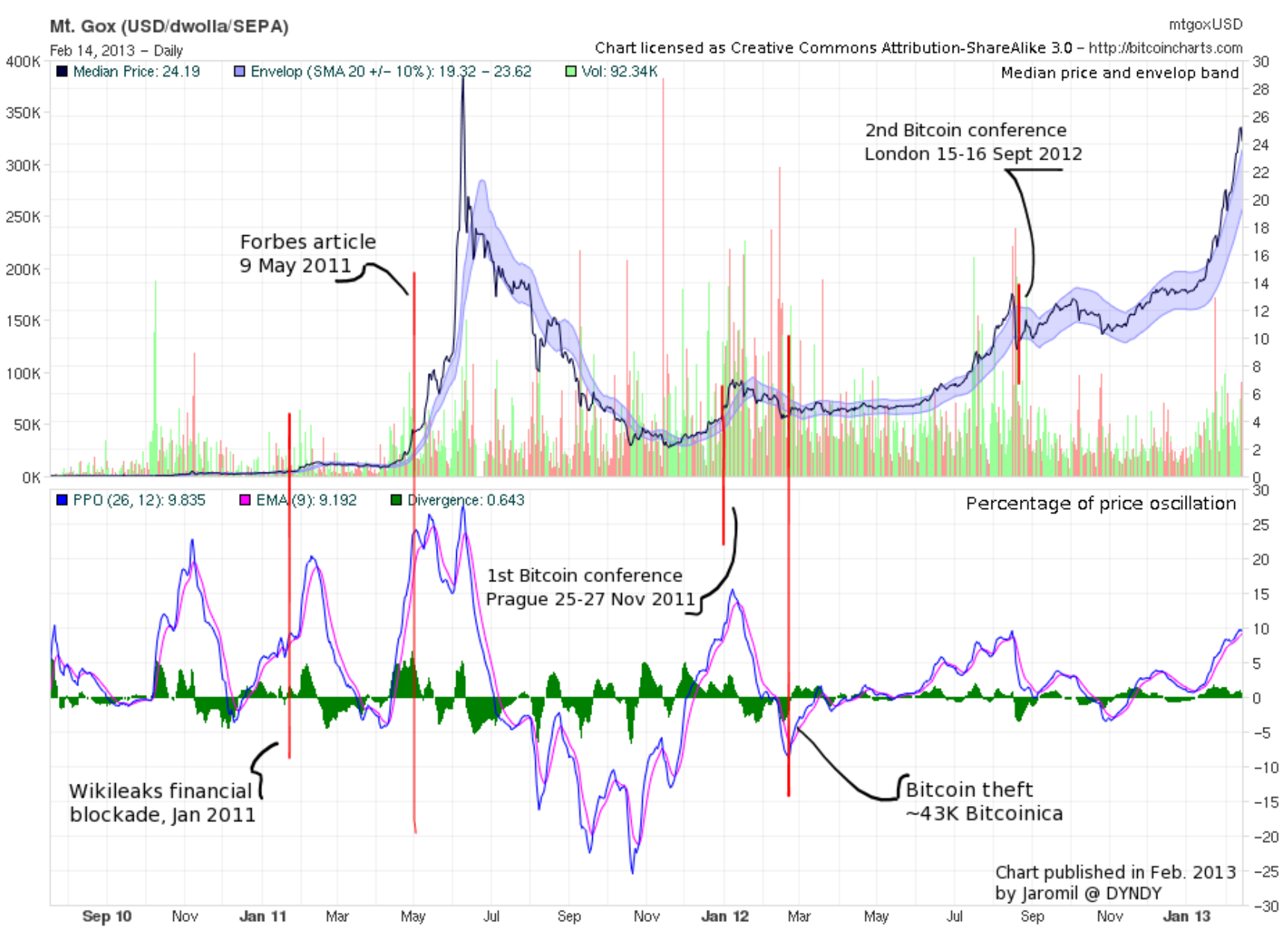

This was a disruptive episode (καιρός) for the growth of Bitcoin: several hackers adopted it right in those days. The growth of Bitcoin started as it is visible in the above figure, just 5 months before the first Forbes article popularized this project on the stage of mainstream finance.

Today we can see how profit-driven interests fragment this movement: one segment is devoted to fraud and speculation, one segment devoted to transformative politics and one devoted to advancing the long-term goals of financial capital. The latter has been gaining considerable traction in the past decade as a growing number of financial capital investments are orchestrated using crypto currencies as global capitalist assets. There is nothing rebellious in the way the financial world exploits this technology and, while doing so, history is being carefully rewritten following postures that do not recall any of the real events that led to Bitcoin’s success. Through an endless stream of trade-shows the financial industry mimics the presence of its synthetic leadership ostracizing the public persona of Julian Assange who led the Wikileaks project.

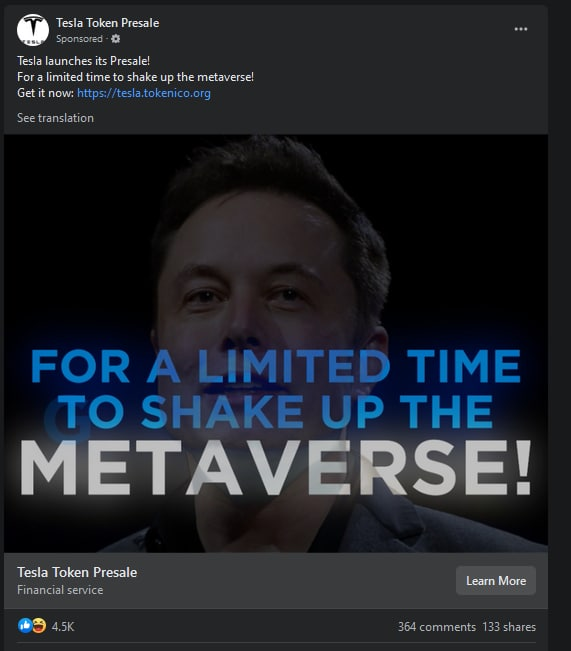

The technical device of the crypto commons movement is put into the service of those forces that it wanted to destroy. In the mainstream and marketing driven space we can observe for instance the “Tesla Token” operation present through social network ads: a mere sale of high-risk crypto investments that is specular to what is already happening in Wall Street. This may be just the tip of an iceberg as more GAMAM mega-corporations move forward to challenge regulations and create crypto-investment tokens whose main feature may be just that to ease the deployment of capital for global financial speculation.

What happened however is that the crypto commons movement was born underground and could share its ethical underpinnings with a vast mass of people around the world: the Crypto Commons movement.

Disintermediation and P2P ideology

“One main problem with anarchism as a social system is about transaction costs. But the digital revolution alters two aspects of political economy that have been otherwise invariant throughout human history. All software has zero marginal cost in the world of the Net, while the costs of social coordination have been so far reduced as to permit the rapid formation and dissolution of large-scale and highly diverse social groupings entirely without geographic limitation.”

– Eben Moglen, 1999

Until a decade ago it was believed that disintermediation would be driven by the adoption of the “world wide web” and Internet technology. Today an updated strategy for this movement is provided by the adoption of cryptography.

A core objective of many free software developers and activists following peer to peer ideologies is that of eliminating intermediaries by following peer to peer network architecture patterns. This phenomenon is branded as “disintermediation” in several economic and political narratives foreseeing this sort of transformation across societies. Most communications today take place in a digital form, at the same time the infrastructure required for them is omnipresent and increasingly generic, capable of connecting people with each other. The fact that most private interactions are intermediated by platform providers is seen as an unnecessary cost in terms of efficiency and liability. In addition, when intermediaries operate following hidden rules (algorithms) just like in a “black-box society”, there is an unfair relationship between participants and the governance they submit to, often hidden behind trade secrets and forced “user agreements”.

As progress increased the complexity of technology however, the practice of intermediation was made necessary to deal with it. The peer-to-peer potential provided by the omnipresent adoption of personal information devices is defeated by increasing technical complexity putting people in difficulty unless the growing sophistication of their needs is served by a global oligopoly of platforms. One or more layers of applications have been built this way, following a “startup economy” model of service provision at the cost of money and private information.

At present scale this situation may well be irreversible. What the crypto commons movement can do today is adopt cryptography to provide communicating peers with an autonomous layer of privacy on top of centralized layers and perhaps even independent from the carriers.

The application of end-to-end cryptography has been adopted at scale on top of centralized infrastructure and privacy-by-design application platforms to provide massively used and even mission critical services as Whatsapp or Signal. It is a way to encode or encapsulate information so that the messengers cannot ever access it, but only deliver it. This also lowers the liabilities of messengers, rendering their role as “neutral” to the content being delivered.

But the industrial drive to profit by marketing people’s attention most of the time leads to very different configurations for on-line communication, where advertisement strategies are adopted by platform providers along with “content targeting” techniques powered by the knowledge of private information about peers. Regulatory interventions so far have been loading platform providers with additional liabilities, for instance mandating content moderation rather than disintermediating their role and neutralizing their access to content.

Disintermediation is then just a naive challenge for the crypto commons movement today: such an idealist concept must be adapted carefully to reshape the way communication platforms work by taking into account different models of ownership and liability at different layers of the infrastructure. Seen from this point of view, a “blockchain platform”, also called distributed ledger technology (DLT) is an infrastructure that aims to be neutral to its contents and provides immutable storage and verifiable distributed computation to all participating peers.

Distributed Autonomous Organization

“Token engineering and DAOs are shattering the basic structure of the old world. The old world is corporate, hierarchical, and rigid. This new world is rich, intense and creative.”

– Dark Finance Manifesto

The so-called Distributed Autonomous Organization (DAO) was envisioned at the early stage of the crypto commons movement as a governance device to serve a decentralized and pseudonymic group of shareholders. The organization is envisioned to be autonomous because of its complete independence from a centralized infrastructure: access to decision making processes is sealed and granted only to legitimate participants by means of cryptography (not by a platform-enforced convention) and capable of being hosted by a blockchain platform (DLT).

In practice a DAO is like a crowdfunding platform that allows investors to participate in the governance of the funds.

The DAO concept presumes that access to a DLT is available to all shareholders to allow members to vote on collective decisions and transactions in a distributed and asynchronous way. Votes may be held during certain time-frames and more sophisticated governance rules may be adopted, for instance that each voter may exercise a weight that is proportional to his or her investment or commitment into the project, which may be measured in various ways and not just by means of a financial stake: from using a simple time-bank to adopting different reputation and delegation systems up to more sophisticated governance models as “Conviction Voting”.

Let’s observe a visible trace of the historical ethos of the crypto commons movement: it is not a coincidence that the richest DAO existing so far is the “Assange DAO”, an initiative promoted in coordination with Julian’s family and the Wau Holland foundation to raise funds for the legal defense of Julian Assange.

To describe the governance dynamics of this particular DAO is beyond the scope of this essay and its FAQ should be taken as the ultimate source of information on the topic. In brief, the Assange DAO’s mission was to raise funds for Assange’s legal costs and it planned to do so by “pumping” the price of a “benefit NFT sale” by crowdfunding the auction’s highest bid. The DAO accepted ETH as crypto currency through a third party escrow service (Juicebox, built on Ethereum and governed by a centralized organization) that granted donors warranty for good conduct and technical reliability of the DAO smart contracts. As a token of gratitude donors received a freshly minted currency ($JUSTICE) created only on this occasion and for a fixed amount proportional to the DAO funds. Those who held $JUSTICE were then invited to interact through an on-line forum and text and voice chat channels hosted on Discord to decide on the governance of the token and some remaining funds that backed it as reserved; such governance were facilitated by a board that included some of the DAO’s promoters and elected new community members; they were also very crowded meetings, perhaps even beyond what the board or the technical design of the platform could really facilitate as inclusive interaction.

What is interesting to note as an outcome of this and other big DAOs is that the technology per-se (be it completely or partially decentralized) did not provide a solution to the many challenges posed by large and distributed governance models.

Most DAO platforms today resort to the adoption of semi-centralized platforms and escrows that grant custody services for their assets and help overcome the growing complexity of needed cryptographic setups. The DAO governance features are defined by complex collections of “smart-contracts” written in programming languages that are understood only by a technical elite. The communication channel most adopted in DAOs is a proprietary and centralized platform called “Discord” initially popular among gamer communities and, to the detriment of peer-to-peer aspirations of the crypto commons movement, it hosts most of the debates and human communication processes that are fundamental for the formulation of voted decisions.

It is important for the crypto commons movement to cross a stage of disillusionment and learn from present faults. The DAO model calls for more research and development in the direction of governmentality for big and distributed networks that are culturally mixed and multi-language, since existing social network models aren’t doing well when it comes to facilitating willing participants to steer decisions andare far from providing a device that helps participants solve this challenge at scale.

What lies behind a Smart Contract

“Smart” is an euphemism for magic / enchanted / cursed (unfortunately, it usually means cursed)”

– Caleb James DeLisle

The ambiguity of the “smart” concept is due to its semantic abuse in an endless quantity of techno-hypes. Then it often happens that someone asks a logical question: what does “smart” really mean?

Let’s dig into the “smart contract” definition adopted by mainstream blockchain technologies. The “smart” feature has little to do with the language used: it is not about intuitiveness or outreach in execution capabilities. An educated guess may lead one to think that “smart” refers to the ability of a contract to contemplate different conditions and adapt to them, or perhaps to the proximity of the contract language to the syntax of human language. Instead it seems that the “smart” euphemism is improperly used as it does not signify features as wit, intuitiveness, adaptability or ease of access.

To distinguish this sufficiently advanced technology from magic I’ll hereby formulate a definition of what is mostly intended by “smart contract”: it is bytecode that can run deterministically on a decentralized computation network that is resistant to malicious instructions and whose execution results are verifiable by means of reproducibility and peer to peer consensus.

I will briefly explain my use of terms in the previous phrase by specifying their intended meaning.

Determinism: unknown random values are never mixed during the computing process so that, given the same data inputs, the exact same outputs can be always obtained in any execution condition on any machine architecture. This also means that execution is a “duplicable” process (could be also defined as reproducible or reversible) and can be verified.

Decentralized: no central point of execution is defined so that any machine executing the code will have the same level of authority than any other when stating the results of the execution. Consensus algorithms will weight results through deterministic computations and eventually overcome discrepancies and exclude outliers.

Malicious code: no declared intention for the execution is imposed on the code, it may even aim to consume the resources of an entire network of machines. All code has to be executed: it is up to the machines to defend themselves from malicious intents by limiting the conditions of code execution, for instance a limit in computation cycles.

Let’s envision this design as a small series of forms and functions.

| Execution / Function | Infrastructure / Form |

|---|---|

| Decentralized | (Virtual) Machine |

| Malice resistant | Limited execution |

| Deterministic | Reproducible |

This configuration has important economic and political implications, primarily the separation between infrastructure (production means) and application (executed logic) by means of virtualization and portability. In Marxian terms the ownership of the infrastructure necessary to execute “work” is the condition that makes it possible to extract plus-value from workers. Now this relationship between property and power is – at least theoretically – transformed by the fact that execution is made completely interoperable across a variety of infrastructures. This is arguably only true when the computing requirement of that infrastructure is small: Bitcoin mining is a good example of how the rise in infrastructural requirements leads to centralization and is intertwined with ownership of external production chains, for example hardware manufacturing.

The innovation lying behind the term “smart contract” focuses on the contract language and virtual machine as building blocks to scale up platform infrastructures at great sizes, while providing access to advanced cryptographic computations that seal contents in a programmable way.

In light of this it should become obvious how slow is the pace at which the larger public picks up the possibilities offered by crypto. Non-fungible tokens (NFTs) have stormed the art world by implementing an artificial notion of property borrowed from simple notarization crypto contracts.

To debate NFTs is not really interesting the crypto commons movement; perhaps such a debate will hint at a critical reflection on the mainstream art world functioning as a commodified market for money laundering; or on the power of the entertainment industry in synthesizing digital commodities while lowering their marginal production costs. I believe it will take a long time before we see more of the basic crypto innovations hitting mainstream markets and industrial verticals: the collective imagination seems to be numbed by the road-shows of financial-industry and the NFT phenomenon leaked its sociopathy into the art world with the only merit of unlocking access to a few unknown artists and entertainers.

Web3 and the development challenge

“Zencode is a project inspired by the discourse on data commons and technological sovereignty. The established goal is that of improving people’s awareness of how their data is processed by algorithms, as well as facilitating the work of developers to create applications that follow privacy by design principles.”

– Zencode Whitepaper

So far I have defined the socio-political background and some key challenges and features defining the goals of the crypto commons movement. I will now give a definition of the so-called “web3” platform by putting the puzzle pieces together.

I explicitly leave out the digression on an etymological definition of the “web3” term led by interpretations of how Internet decades can be associated with different versions of the “web”.

The real meaning of the “web3” marketing brand for software architecture can be made obvious for all those who know how DLTs work: it refers to a decentralized infrastructure for distributed computation that is entirely hosted by participating peers and scales without friction.

The core components of a blockchain/DLT in the “web3” acception are four:

1. The peer to peer network layer

2. The consensus algorithm

3. The virtual machine

4. The immutable ledger

Then there are two optional components mostly related with state persistence:

5. (optionally) a peer to peer distributed file system

6. (optionally) oracle notarization for legacy databases

On top of this infrastructure then “smart contracts” scripts run to operate rather simple functions, most commonly found building blocks (primitives) are:

– Authentication: sign (single or multi) and verify

– Access: access control lists and ownership

– Governance: voting and time-lock

– Cross-chain: atomic swap and multi-layer blockchain communication

– Financial: token transactions, vesting, split-pay, lend/load, royalties etc. etc.

The so-called “web3” constitutes a new condition for the creation and execution of applications: it separates the liabilities of the platform from what is executed on it, allowing it to scale its computational capacity by welcoming unknown and untrusted peers to run its executions. Aligned with the financialised dimension of crypto-platforms, the peers are motivated by “transaction fees” paid to them in exchange for their computing cycles.

But this all comes at a cost: that of very difficult development due to the cryptographic complexity layer that needs to be added on what would be normal scripts. For the casual developer having basic notions of cryptography this is just becoming even more difficult with the advent of advanced cryptographic techniques for zero-knowledge proof and multi-party computation. The real arms race in DLT development cannot be measured just quantitatively with the “speed of transactions”: developer experience and facilitation needs to be considered, once again the human role is crucial. The rise of web3 applications highlights the role of the virtual machine and weighs the complexity of languages that make distributed computing possible.

For instance to preserve the privacy of participants or the confidentiality of a vote one may not simply increment a counter or match identifiers on a database, but has to operate distributed and fully deterministic computations in a “cryptographic dimension” and apply:

– homomorphic encryption to hide the status of a vote until tally

– zero-knowledge proof to hide the identity of voters while authenticating them

– simplicial homology to grant only one vote to each voter

– fast rainbow-table hashing to tally the result of a vote

Any entrepreneur in the ICT sector today knows that finding experienced developers is harder than finding clients: even with the ever increasing offer in technical education it is hard to imagine that the big-tech industry will catch up with the increase in technical complexity.

The current limit of web3 is double-edged: the simplicity of the applications that can be developed and the qualitatively higher complexity of development. This limit, together with the hype-driven market for computation tokens, is what keeps costs rather high, at least today.

Livin la vida crypto

What I’ve written so far should make clear that, by virtue of crypto design patterns, the integrity of an application and its results may be completely separated from the blockchain/DLT infrastructure that runs them, while all participants can be reassured about the correctness of the inputs, the processes and the outputs.

Operating in crypto does not mean “freedom”, pardon me if I curb anyone’s enthusiasm here, but a shift towards a new trust model in provable computing that de-materializes infrastructure into code. The quality of code becomes more important than that of the infrastructure and, from a labor perspective, developer roles gain importance towards system administrator ones.

All things considered, I believe that “freedom” for this technology means the possibility to abstract the virtual-machine running the computations and migrate it easily to multiple DLT infrastructures, breaking silos that the industry is already actively reproducing from its previous configurations while jumping on the crypto bandwagon.

The advantage of crypto is not in speed or efficiency, but in a new and generally less risky and more scalable condition of interdependence, trust and liability between infrastructure and applications. Is this the “future of the web”?

I wouldn’t say so, but it is a new opportunity that comes handy and is worth developing further for use-cases where trust cannot be easily established between peers willing to join forces to provide a scalable infrastructure. For example in logistics when tracing goods through processes operated by different companies, for digital product passports for the track-and-trace of components through complex graphs of repurposing in circular economy scenarios, for the immutability, timestamping and auditability of nuclear safeguards as values given by dosimeters carried by power plant inspectors may differ from those carried by on-site workers.

The collective ownership of base infrastructures and the lower liability provided by abstracting them from applications represents a political opportunity for platform cooperativism, but the functionalities such a setup may offer are far from being advanced and efficient enough to compute sophisticated applications as for instance Uber, Airbnb or Deliveroo are today.

On the other hand such a platform architecture makes it difficult to point at liabilities when needed, as well illegal services may not be inhibited from running: the claim of “Decentralized Finance” (DeFi) is precisely that of running financial exchanges that are completely decentralized and whose operations cannot be shut down.

In any case the future of the crypto commons movement lies beyond financial applications: they are just the first use-cases to emerge out of a range of wider future possibilities of decentralized service development. As it was with Bitcoin, first movers always come from the fringes of legal frameworks, and this may soon prompt regulators to make a dangerous move I advise against: identifying liabilities in the act of developing software rather than executing it and running it as a service.

Unchain my blocks

“Lunarpunk is more like a forest. A dense cover of encryption protects tribes and offers sanctuary for the persecuted. Wooded groves provide a crucial line of defense. Lunar landscapes are dark. They are also teeming with life.”

– eGirl capital

In a certain dystopian future the term “software piracy” may acquire a whole new meaning and it will be up to the crypto commons movement to defend the freedom of decentralized system developers as Satoshi Nakamoto, the creator of Bitcoin, who has aptly chosen to hide himself and his or her real identity following the famous last sentence:

“WikiLeaks has kicked the hornet’s nest, and the swarm is headed towards us.”

– Satoshi Nakamoto, 11 December 2010

If a censorship war is ever started against developers then a whole new sort of “lunar” software licenses may be needed, or perhaps no licenses at all: just public domain software maintained by anonymous developer collectives.

But this negative scenario is not the only one that should interest us. The term “infrastructure as code” popular among “devops” roles of the tech industry hints about the growing importance of language creativity when compared to the classical role of system administration to operate platform infrastructure.

I believe the crypto commons movement has a clear mission: to shape and defend the techno-political evolution of information technology platforms outside of the logics of property. The new conditions for anonymous collective ownership of decentralized information architectures require us to understand a new ethical sense for computational democracy.

The unconditioned accessibility to and governmentality of programming languages will be of growing importance, even more than free and open source practices are already today for the crypto commons movement.

“[…] the distinctive challenge that the virtualization of a growing number of economic activities presents not only to the existing state regulatory apparatus, but also to private-sector institutions increasingly dependent on the new technologies. Taken to its extreme, this may signal a control crisis in the making, one for which we lack an analytical vocabulary.”

– Saskia Sassen, 1996

The “analytical vocabulary” should serve the purpose of making humans understand how machines operate in increasingly complex configurations. But unfortunately most of the industry and public research efforts are pushed towards the opposite direction: that of making humans understood by machines in an endless stream of “artificial intelligence” technologies whose subsistence is based on the subjugation of human labor to feed machine learning.

As a propositive conclusion I would like to share a few ways I see the crypto commons movement can go beyond the mere application of financial gambling or digital property attributions.

The crypto commons movement ideal will be that of making humans understand machines: to envision new trust models in cybernetics and fight back the supremacy of centralized black-box governance. The crypto commons movement challenge is to create deterministic conditions for replicable computation, implement algorithms whose mode of operation can be scientifically proven, communicated with simplicity and democratically debated. Algorithms of dissent.

After more than a decade of studies in this field my contributions to this mission and the crypto development world are closely shaped after this vision of a crypto commons movement.

One contribution is the Dyne.org foundation effort, in coordination with DECIDIM and Platoniq, to improve collective governance methods by adopting a techno-political approach for practices that involve large multitudes of people and facilitates them into a constituency to make conscious choices that improves their life and general conditions of freedom, justice and peace in society. As part of this journey we engaged the challenge of running the nation-wide platform “Agora’ Democratiche” for Italy’s Democratic Party, giving us a lot of on-line and on-site experience and an occasion to refine our intents and be ready to reliably facilitate new challenges.

Another contribution is the development of Zenroom.org as a free and open source software virtual machine written with artisanal passion for details. This tiny VM can run very efficiently on any machine, low-power chip or browser and is programmed using a human-like language called Zencode, so far translated only to English. Zencode is a smart-contract language designed to be understood by humans and it can compute advanced cryptographic functions as zero-knowledge proof and multi-party computation compatible with Bitcoin and Ethereum 2.0.

Another one is the development of a digital product passport to trace material flows and digital twins in a secure, portable and decentralized way. The relevance of this project is best explained by its use-cases which are well beyond simple financial applications, for instance circular economy or distributed design.

Now that we have empowered ourselves with financial autonomy we need a crypto commons movement that moves well beyond financial applications and focuses on sustainability and justice, progressing new ways to deal with trust and complexity in social organizations and institutions. As it was well envisioned at the birth of modern liberal thought, we need to grant ourselves and future generations the liberty to progress and grant everyone the right to be creative and develop environments that do not deceive humans with dogmas and lies.

“There can be no liberty for a community which lacks the means by which to detect lies.”

– Walter Lippman

Read the texts in the series:

From Commons to NFTs: Digital objects and radical imagination by Felix Stalder

Can NFTs be used to build (more-than-human) communities? Artist experiments from Japan by Yukiko Shikata

Ethical Engagement with NFTs – Impossibility or Viable Aspiration? by Michelle Kasprzak

The Real Crypto Movement by Denis ‘Jaromil’ Roio

My first NFT, and why it was not a life-changing experience by Cornelia Sollfrank

It is getting harder to have fun while staying poor by Jaya Klara Brekke