It is getting harder to have fun while staying poor

Published 30 June 2022 by Jaya Klara Brekke

“From Commons to NFTs” is an (expanded) writing series initiated by Shu Lea Cheang, Felix Stalder & Ewen Chardronnet. Cautioned by the speculative bubble (burst) of NFTs, the series brings back the notion of commons from around the turn of the millennium to reflect upon and intervene in the transformation of the collective imagination and its divergent futures. Every last day of the month Makery publishes a new contribution of these “chain essays”. Sixth text by Jaya Klara Brekke.

On bootstrapping markets to make new meaning, new dreams and new dawns

It is getting harder to be poor said my father. That was probably about fifteen years ago and since then it seems to have only been getting harder. I found it a strange statement. Surely, I thought, you are either poor – and that’s no fun – or you are not and all is dandy. But as my mental model matured through that generative combination of experience and reading it started to make complete sense: there are places in this world where it is fairly easy to have fun without money and others where every laugh is locked into a dense network of economic calculation, smiles serving as f.o.m.o. food for a profit margin, making it near impossible to be moneyless and still considered part of society. The fact of the matter is that when you are in one of such places, money does feel very much like freedom, because it is your general-purpose access token that also connects you with a broader network of material and social relations. In such a context it is very easy for the commendable struggle for freedom to be conflated with the struggle to make a bag.

Every essay starts with an itch that needs to be scratched, and in this instance it is a personal itch because my very first interaction with peer-to-peer technologies was via BitTorrent, the OG protocol of decentralised file sharing around which a whole philosophy emerged epitomised in the saying Sharing is Caring. Alongside the Pirate Bay, this was a digital movement that was fundamentally critical of the imposition of artificial scarcity in the digital realm, where the copying and sharing of a bit was a laudable clandestine expropriation of an enclosed cultural and knowledge commons.

As the editors of this series put it: “Abundance has been replaced with a focus on scarcity of information and open access with a system of fine-grained permissions.” [1] So here is the itch I want to scratch with you as you scroll down the next many lines: why did peer-to-peer technology go from being a means through which to circumvent attempted enforcement of scarcity and access control, to instead become a means to radically advance new forms of scarcity and digital property forms with everyone seemingly rushing headlong to their chains? How did a digital movement supposedly about disintermediation explode into a myriad of new forms of tokenised intermediation, every interaction requiring bespoke new rights designs?

(It is getting harder) – property is still theft

The very first attempted real world application of smart contracts was in 2015 and it was a lock, coded up, built, prototyped and presented by Slock.it [2] It was almost poetic for me to witness at the time, because being an early doctoral student of the politics of blockchain, it was such a perfect physical representation of an inkling I had already then. Namely that blockchain was going to popularise a populist version of personal property rights in the digital. A set of keys, a ledger of ownership, what better meatspace materialisation than a lock. From that moment onwards, it was clear that Bitcoin had unleashed not just a computational but also an ideological algorithm that would repeat the practises of artificial scarcity and its associated speculative markets as a fractal echo across the digital, from layers 1 to layers 2, and across applications.

Property is theft. The famous quote from the 19th century anarchist theorist Proudhon [3] communicates the crux of the critique brought forth through the concept of the commons: that value is never created in isolation, but in fact stems from the practices, ideas, knowledge and culture of centuries of humans as well as the ‘raw material’ of millennia of co-evolution with non-humans. It then follows that to cordon off one part of this multifarious morass of the living, and call it ‘my property for my profit only’, amounts to thieving (or in the more scientific sounding Marxist terms, primitive accumulation). Now, once some part of the world has thus been thieved from the commons, it will be locked up as property, and money will play the key role in unlocking access. Which means that as more and more of the world gets cordoned off in such a manner, money takes on an increasingly important role as a required access credential, a universal token (within a given territory). Which means that when the lock is also put on the essentials – water, food, housing, care, culture and knowledge – it starts to get very hard to be poor indeed.

It is getting harder to be poor. And the compounding of the promise of private property has a major fault in the state of affairs. In neoliberal economic development there was a hugely influential book that came out in 2000 titled ‘The Mystery of Capital’ by the author Hernando de Soto. In it, de Soto argued that the reason why poor countries of the world remain poor is for the simple reason that they do not have formal and adequate protection of property rights. If people in shantytowns would simply be granted formal titles to a piece of land, he argued, they would then be able to leverage this to get loans to start businesses and lift themselves out of poverty – problem solved by granting more people and places access to global markets. Which is to say granting global markets access to more people and places. de Soto’s work is pertinent because a similar structural adjustment saviour complex is simmering in the crypto space. Decentralisation seems all too often to reproduce existing financial, economic and legal concepts just in a new decentralised form. New tooling enabling everyone to engage in the same extractive activities previously suffered, become a bank, lender and landlord – lauded as liberation. But more financing, spewing more money merely multiplies the locks in much the same way that more roads merely incentivises more driving rather than solving congestion.

Now when I came across Slock.it, I laughed at the time, out loud, for so perfectly fulfilling my expectations. I thought to myself with that smugness that characterises so many self-proclaimed political radicals: clearly, I thought, here we see a banal replication of financial capitalism as we know it. After a brief moment of believing Bitcoin to be an answer to the status quo that had caused the 2008 financial crisis as the culmination of decades of economic imperialism, decentralisation instead degenerated into an assemblage of atomised individuals now free to play at being mini-replicas of digitally simulated mortgage industries, banks and legal systems [4]. But then and there I also decided to not write a cookie cutter left critique of blockchain and instead “stay with the trouble” [5] as we are all increasingly compelled to, and try trace what these technologies are really doing for people. In a context of generalised commodification, having money does amount to a very basic freedoms, making it profoundly dishonest for those who have plenty to pontificate political purity telling the broke not to make a bag by whichever means necessary.

While pointing out the Ponzi is an important role to play, it is equally important to investigate the detail of what else is going on here. For example the idea that NFTs can somehow convince people of purchasing such property rights without policing access and enforcing scarcity [6] is a curious cultural shift that is clearly not just a replication of DRM in decentralised form. As I have written elsewhere [7], the current movement of decentralisation is less driven by a particular political or economic doctrine and more by vague dreams and desires of decentralisation, MMOs generating plentiful play on possible futures. So how does one have fun under our current conditions, and where do we go from here?

(To have fun) – building castles

Money is not the same as tokens, and tokens are not the same as non-fungible tokens. Where fungible cash money is a universal access token and public utility of value transfer, tokens and NFTs are like refractions, bespoke variations on the themes of access, value and belonging. Thinking of tokens and NFTs as a myriad of new forms that these themes could take can be a helpful way to understand what they do in the world. Material theorist of money, Lana Swartz, has pointed exactly to that importance of the form, or the medium, of money in producing ‘transactional communities’ [8]. Going back to the 18th century US (and one could easily go back further to a number of other empires), Swartz traces how the pictures printed on dollar bills tied together multiple migrant language groups into a national scale network of exchange. Using images and numbers meant that no further translation was required. People spread across vast territories and different languages were thereby constituted as a “population”, tied together not just as an ‘imagined community’ but through transactions making such symbols matter more materially. An analysis that indeed also suggests that the multiplication of new money forms could be heralding a significant shift, or multiplication of new types of transactional communities. The power of pictures combined with economic function is particularly interesting to think through when it comes to NFTs.

Far from being merely an enclosure of the commons or glorified JPEGs, NFTs seem to have added the key ingredient of culture to what I have elsewhere described as technological takfirism [9], managing to make these cold economic constructs so very human and relatable. NFTs make out a cultural form of a new class, with specific reference point in not just meme culture but also net-based politics. Here I am thinking specifically of the ways that NFTs enact shared community through imagery, ownership and a real stake in a community, namely DAOs.

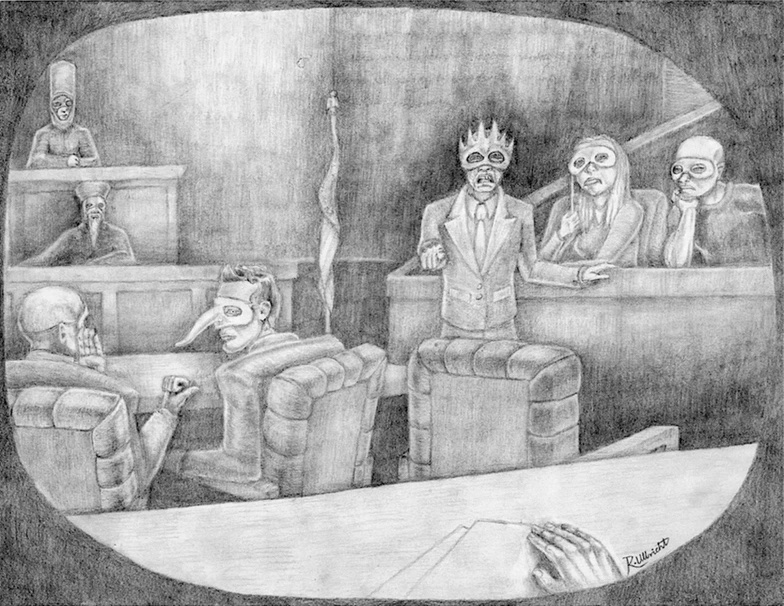

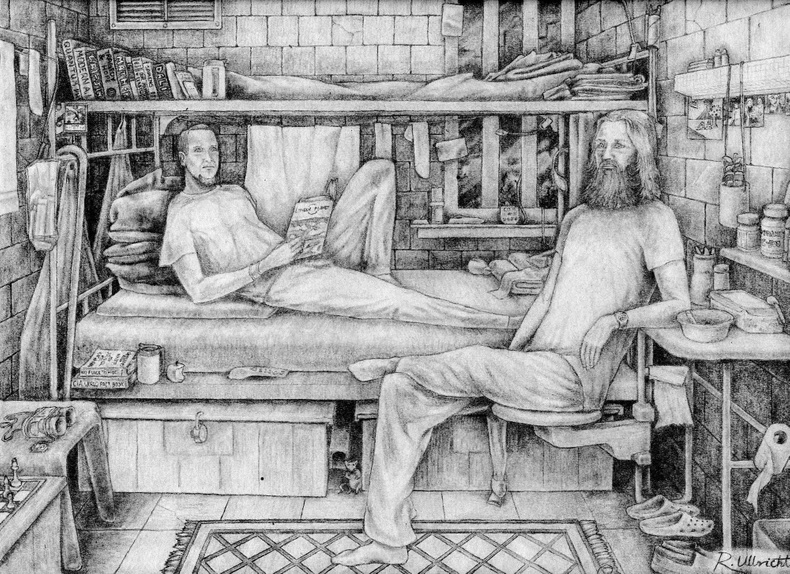

Two examples spring to mind the Free Ross DAO and the Assange DAO. Ross Ulbricht is the dark net dude that started Silk Road, the market place the whole world was buying drugs from in the 2010s. And he is currently in prison. He received life sentence for simply setting up a site, a fact that affronted a number of supporters who started a DAO to support his case [10]. The DAO managed to raise $12.5M [11] to bid on a series of NFTs titled the Genesis Collection: delicate and personal line-drawings that Ross had done throughout his life, from childhood to prison [12]. The family charity Art4Giving[13] collaborated with Entopic to auctioned the Genesis Collection at Art Basel. The Free Ross DAO bid was successful, raising $6.2M that went to the Art4Giving charity . The DAO then issued a token called FREE representing a fractional ownership of the Genesis Collection NTFs, and the FREE tokens were distributed to the DAO community as governance tokens for the remaining treasury of $5.5M [14]. If crypto plugs people and their projects up to financialised flows, governance tokens and NFTs offer meaning and a means to take part in these in terms of community, culture and decision making that materially matters.

The Assange DAO was directly inspired by the Free Ross DAO. Carrying forward the cultural canon history of crypto itself, the DAO references the cypherpunk roots of Julian Assange and Wikileaks, being – as pointed out by Jaromil in this series [15] – the first major anti-authoritarian use case of Bitcoin. The Assange DAO began mobilising in December 2021 when the US government won its appeal to extradite Julian Assange from the United Kingdom [16]. And similarly to Free Ross DAO, it coordinated a bid on an NFT series, this one a collaboration coordinated by Assange’s brother between the artist PAK and Assange to create a collection titled Censored [17]. The collection included a clock, counting the days Assange had been in prison. The DAO coordinated the winning bid at a staggering $55M worth of ETH (at the time). A governance token was minted ($JUSTICE) for people to vote on and take part in the DAO although where Free Ross DAO had a treasury remaining after the bid, this time the entire amount was transferred directly to the legal defence fund managed by the Wau Holland foundation [18].

There is much to the critique that NFTs entail some sort of cooptation of culture by economics and finance. But conversely, it also seems that NFTs represent a cooptation of economics and finance by culture. And here I draw inspiration from Graeber’s 5000 Years of Debt [19] as well as his and Wengrow’s recent Dawn of Everything [20], both volumes that open up the mind to the sheer magnificence and insanity of ways people have organised their relationships to one another, the earth and the cosmos. Experiments drawing together a mad mashup of maths, mystical knowledge, bureaucracy and violence. Their central question being why the powers of imagination of a truly different ways of living together -indeed an imagination and plurality that has characterised most of human history- has been so thoroughly captured and regimented in the particular era we are living through.

This is partially why, instead of simply rehashing the well-worn warnings and wisdoms of the digital left, I find it important to stay curious about what these new constellations of belonging and rights management actually do for people. And to suspend the judgment that comes so naturally to the politically schooled and read more than mere naiveté or cynicism into these castles and citadels of code. There are some interesting synergies between the more sincere efforts of token and NFT innovation and Graeber and Wengrow’s central argument, namely that scale should not have to necessitate hierarchy, wage slavery, bureaucracy and force. One of their curious discoveries is that maths and spatial arrangements have been used a means to architect mutual and horizontal responsibilities of care at scale, in ways that might be inspirational to current efforts. As examples, they mention the pre-historic urban formation known as a ‘mega-site’ in Nebelivka, Ukraine, as well as a more contemporary example from France:

“In the commune of Sainte-Engrâce, for instance, the circular template of the village is also a dynamic model used as a counting device, to ensure the seasonal rotation of essential tasks and duties. Each Sunday, one household will bless two loaves at the local church, eat one, then present the other to its ‘first neighbour’ (the house to their right); the next week that neighbour will do the same to the next house to its right, and so on in a clockwise direction, so that in a community of 100 households it would take about two years to complete a full cycle. (Graeber and Wengrow, 2021 p295-296)

The arrangement of taking turns in an mathematically organised manner in order to avoid hierarchy shares somewhat similar sentiment as proof-of-work principles. The major difference of course being the cold war assumptions inherent in cryptoeconomic networks, as opposed to the cosmologies of sexual reproduction–indeed a concern with ensuring biological rather than financial forms of growth:

As so often with such matters, there is an entire cosmology, a theory of the human condition, baked in, as it were: the loaves are spoken of as ‘semen’, as something that gives life; meanwhile, care for the dead and dying travels in the opposite, counter-clockwise direction. But the system is also the basis for economic co-operation. If any one household is for any reason unable to fulfil its obligations when it is time to do so, a careful system of substitution comes into play, so neighbours at first, second and sometimes third remove can temporarily take their place. This in turn provides the model for virtually all forms of co-operation.” (Graeber and Wengrow, 2021 p295-296).

Now, one might wonder, couldn’t the Assange or the Ulbricht families simply have set up a go-fund me and saved a lot of hassle? Maybe. If you consider money as merely facilitating a straight forward transaction. But reading Graeber and Wengrow offers a decidedly anthropological spin to all things economical, revealing the draw of deeper constructs and cosmologies, the stuff of marketing more than material infrastructure.

Tokens, NFTs and the many money new forms tie people up in transactional communities through their particular and peculiar rituals. To issue a token is to conduct a ritual that can open a portal into the pockets of the peculiar transactional communities of crypto markets; and issuing a conceptual art NFT can conjure a portal into the purses of an art market keen to keep up with the latest technological trends; both communities that are unlikely to be reachable by means of go-fund me. These new digital artefacts should not be merely be read through a utilitarian lens – although their utility, when successful, is literally the difference between raising $10.000 or $10million. Life is thoroughly driven by shared culture, meaning, dreams and desires. Strangely, by making economics the crux of the critique, much of it is left in the dust, all too sensibly still arguing with the economics while others are off building castles in the code [21].

(Staying poor) – no one wants to be a victim

Nevertheless I keep glancing around thinking to myself that surely everyone is aware that these castles, citadels and cathedrals are built on a bubble. A bubble on more bubbles. How many are secretly eyeing their exit, here to rake it in before the casino (the world) catches fire (climate breakdown)? While this playground might be plugging some people into hitherto unseen streams of sustenance, collectively it is clearly a catastrophe. Value extracted from the future daydreams of your fellows, to materialise into the present-day pockets of those with a good exit game (or just plain lucky). I am writing this as the entire crypto market has lost two thirds of its market capitalisation and NFTs very much following that trend. This is an important reminder that while there might be a thin crust of glittering economic empowerment to be gained by plugging into these novel I/Os of finance capital, beneath lies molten mass of market makers, making moves for crypto companies, whales, VCs and institutional investors in heating up an ever more elaborate bubblebath of bets on the future.

No one wants to be a victim. Which curiously means that when critics point to the losses, they, as much as the markets, risk losing audiences. Wins and losses are at this point par for the game. Pulling your socks up and plugging in to the matrix of such molten markets of financialised capital, even when you loose some, just feels that much more empowering than waiting around for social democracy to save you. At least it feels like you are in the driving seat, the maker and breaker of your own fate on a hero’s journey to somewhere else. Economic incentives work, and they work even better when that incentive comes in the form of a token that is never really limited by its current value, but rather referencing a future full of 10x potential. That potential, however volatile, reveals the limitations of victimhood that to some degree characterises a Left held together in reference to labour – competing with the daring dreams that capital continues to conjure.

Fast forward a hundred something years after Proudhon’s critique of property and the intellectual Pirate Bay spread notions of re-appropriation of cultural commons. The commons was very much an effort to carve out an exciting political project of plenty that would point beyond victimhood. A project not leaning on a left labour worker identity, but instead articulating an autonomous zone entirely outside the claws of capital, constituted on its own principles. Contemporary heroes such as Alexandra Elbakyan of sci-hub continue that quest [22], turning pirate to ensure the availability of scientific knowledge as a global commons. The dream was/is a radical decommodification that might reverse the trend of ever-multiplying locks, markets and moneyed intermediation, opening up spaces of shared ownership. And as for that frequently referenced tragedy of the commons [23], there is only a tragedy when there is no common cosmology that ensures its ongoing care and tending.

The lack of convincing cosmology is unfortunately also the weak point of recent intellectually informed movements for the commons. Over the past couple of decades the commons has been largely conceptually driven, at least in its European articulation. Philosophers, lawyers and economists engaging a kind of intellectual willing-into-existence of an outside of capital that might exist elsewhere (perhaps Latin America, perhaps in middle age England or mythical hunter gatherer societies?) But the cosmology has felt constructed, abstract and never felt full. Sharing, caring and commons are ideally some of the outcomes of post-capitalist aggregate arrangements, but cannot really serve as the origin story for anything remotely like a new dawn of humanity. These values are neither on par with the power of nationalisms nor holy books in directing the deeper depths of human dreams and desires. Meanwhile, alt-cosmologies are very much making a come-back, nationalism fuelling a failing Russian invasion while a Bible revival has the US collapsing into civil war.

Among the NFT and DAO there are some weird and wonderful experiments in how to tie communities together around myth, resources, responsibilities and rewards, attempting to answer to the failure of imagination lamented by the likes of Graeber and Wengrow and before them, Fisher [24] and Jameson [25]. Whenever the markets crash, there is still code left standing along with some rhythms and rituals rehearsed for a different dawn. And that, in a nutshell, seems to be some potential gains from these games. I applaud the critiques leveraged by the Moxies [26], Jemimas [27], Gerards [28] and Diehls [29], pointing out the technical, monetary and financial fallacies of these new financial fantasies. But while the casino burns, the dice are still being rolled as if to see how much can be siphoned off – a race to see just what social and technological infrastructure can be bootstrapped before it all burns.

While it might still be “easier to imagine the end of the world than the end of capitalism” crypto tokens and NFTs makes it just a little bit easier to tap the end of capitalism for those funds you will need in order to imagine new worlds.

Notes

[1] See https://www.makery.info/en/2022/01/31/english-from-commons-to-nfts/

[2] See https://blog.slock.it/the-history-of-the-dao-and-lessons-learned-d06740f8cfa5. Slockit is a company now more in/famous for The DAO, the world’s first explicit DAO which was subsequently hacked, causing a major governance split and the very first Ethereum hard fork.

[3] See https://www.gutenberg.org/files/360/360-h/360-h.htm#linknote-1 (although in this version the famous quote is written as “property is robbery” rather than “theft”)

[4] Not least by creating an entirely new simulated property market for luxury digital mansions, unsurprisingly via a token called KEYS: https://opensea.io/collection/metamansionsbykeys

[5] Haraway, D. (2016) Staying with the Trouble: Making kin in the Chthulucene. Duke University Press

[6] See Brekke, J.K. and Fischer, A. (2021) Digital Scarcity. Internet Policy Review. https://policyreview.info/pdf/policyreview-2021-2-1548.pdf and Lotti, L. (2016). Contemporary art, capitalization and the blockchain: On the autonomy and automation of art’s value. Finance and Society, 2(2), 96. https://doi.org/10.2218/finsoc.v2i2.1724

[7] See Brekke, J. K. (2020) ‘Hacker-Engineers and Their Economies: The Political Economy of

Decentralised Networks and “Cryptoeconomics”’. New Political Economy. Also find it on Sci-hub by searching: 10.1080/13563467.2020.1806223

[8] Swartz, L. (2020) New Money, How Payment Became Social Media. Yale University Press.

[9] Nakamoto, S., Brekke, J.K., Bridle, J. and Vickers, B. (2019) The White Paper. Ignota Press https://ignota.org/products/the-white-paper

[10] See https://www.freerossdao.org/

[11] DAO chain data of $12.5M

[12] See https://rossulbricht.entoptic.io/6/ and https://superrare.com/artwork-v2/ross-ulbricht-genesis-collection-30841

[13] See https://freeross.org/art4giving/

[15] See https://www.makery.info/en/2022/04/30/english-the-real-crypto-movement/

[16] See https://assangedao.org/

[17] See https://censored.art/

[18] See https://www.wired.com/story/assange-dao-nfts-crypto/ and https://assangedao.org/

[19] Graeber, D. (2011) Debt: the first 5000 years. Melville House

[20] Graeber, D. and Wengrow, D. (2021) The Dawn of Everything, A New History of Humanity. Allen Lane

[21] Sci-hub is an open knowledge pirate repository founded by Russian programmer Alexandra Asanovna Elbakyan. Search Sci-hub for the latest live link and learn more: https://en.wikipedia.org/wiki/Sci-Hub

[22] Roing Baer, A. (2021) Moving Castles: Modular and Portable Multiplayer Miniverses available at https://trust.support/feed/moving-castles [visited 28.06.2022]

[23] Garrett Hardin who came up with the term “Tragedy of the commons” follows in the tradition of Robert Malthus in coming up with elaborate social and evolutionary theories to justify the necessary suffering of the people around them as necessary and unavoidable. For his racist politics, see his entry in the Extremist Files by the Southern Poverty Law Center. https://www.splcenter.org/fighting-hate/extremist-files/individual/garrett-hardin

[24] Fisher, M. (2009) Capitalist Realism: Is There No Alternative? Zero Books

[25] Jameson, F. (1994) Seeds of Time Columbia University Press

[26] Read the founder of Signal, Moxie Marlinspike’s experience of making an NFT https://moxie.org/2022/01/07/web3-first-impressions.html

[27] Kelly, J. There is a moral case against crypto Financial Times Opinion (19.05.2022) https://www.ft.com/content/446e0e6a-6858-4e33-a6cf-8c2e302dc75d

[28] Gerard, D. NFTs: crypto grifters try to scam artists, again. Blog (11.03.2021) https://davidgerard.co.uk/blockchain/2021/03/11/nfts-crypto-grifters-try-to-scam-artists-again/

[29] Diehl, S. The Tinkerbell Griftopia https://www.stephendiehl.com/blog/tinkerbell.html

Read the texts in the series:

From Commons to NFTs: Digital objects and radical imagination by Felix Stalder

Can NFTs be used to build (more-than-human) communities? Artist experiments from Japan by Yukiko Shikata

Ethical Engagement with NFTs – Impossibility or Viable Aspiration? by Michelle Kasprzak

The Real Crypto Movement by Denis ‘Jaromil’ Roio

My first NFT, and why it was not a life-changing experience by Cornelia Sollfrank

It is getting harder to have fun while staying poor by Jaya Klara Brekke